It’s time again for that most prestigious of prestigious awards, the 2014 Tax Offender of the Year. The winner of this award must do more than just cheat on his or her taxes. It has to be special; it really needs to be a Bozo-like action or actions. Once again, there were plenty of nominees.

The Miccosukee tribe is still having its battles with the IRS. The tribe is exempt from taxes but its members are not. The tribe has refused to send financial documents to the IRS. The tribe appealed the most recent order that they do provide the data; a ruling is expected soon from the 11th Circuit Court of Appeals. If the tribe loses this round, the battle will likely be over.

Another nominee was John Koskinen. If that name sounds familiar to you, it should; he’s the IRS Commissioner. Mr. Koskinen testified to Congress that, “I’ve tried to tell you the truth every time I’ve been here.” I had a simple question for Mr. Koskinen: Why doesn’t that quote read I’ve told you the truth every time I’ve been here? The obfuscation by the IRS on the current scandal has led directly to the IRS’s budget being cut.

Charles Waldo received a nomination for allegedly emulating Steven Martinez. (Mr. Martinez won the 2012 Tax Offender of the Year award for hiring a hit man to eliminate witnesses against him in a tax fraud case.) Mr. Waldo was arrested on a 50-count indictment for insurance fraud, tax evasion, felony vandalism, and a high speed chase in California. While awaiting trial, Mr. Waldo allegedly hired a hit man to kill witnesses against him. He’s had ten additional counts added to his indictment. At this point, though, these are just allegations; we’ll have to wait until 2015 to see if Mr. Waldo can truly be nominated.

Finally, Rashia Wilson received a nomination. Ms. Wilson received 21 years at ClubFed for tax fraud. Now, she was indicted in 2012 and convicted in 2013. For those who don’t remember her, there’s this from the Tampa Bay Times:

“I’m Rashia, the queen of IRS tax fraud,” Wilson said May 22 on her Facebook page, according to investigators. “I’m a millionaire for the record. So if you think that indicting me will be easy, it won’t. I promise you. I won’t do no time, dumb b——.”

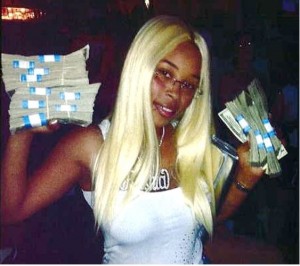

Ms. Wilson also posted this wonderful picture:

In any case, Ms. Wilson, who now resides at a federal prison in Aliceville, Alabama, was ordered to pay $25 each quarter toward the $3.1 million in restitution she owes the IRS. She has asked a US District Court to suspend the payments because she is only making $5.25 each month and must buy vitamins and hygiene items. Ms. Wilson is a reminder to all that bragging about illegal activities on Facebook isn’t a brilliant idea.

Back in 2012 I wrote a post titled, “A Modest Proposal on Tax-Related Identity Theft.” The IRS admits that this is a huge issue. Unfortunately, the IRS is still mostly reactive rather than proactive on this front.

This year, I’ve decided to spotlight an identity thief as the Tax Offender of the Year. I deliberately chose this kind of tax offense because, as the IRS states, “We know identity theft is a frustrating process for victims.” I don’t know of any tax professional with a large practice who hasn’t seen a case of identity theft. My business partner’s late stepfather was a victim of identity theft when his social security number was published on the Social Security Death Index.

Identity theft causes trauma in a victim’s life, and this trauma can last years. The problems can be psychological and actual, impacting the mundane (purchasing), filing a tax return, buying property, and a victim’s self-esteem.

I had literally hundreds of identity thieves to choose from. I naturally chose someone who committed a huge fraud, and whose actions were egregious. For the record, a Google search of the Justice Department’s website looking for “identity theft” for just December 2014 found about 140 entries.

From Smyrna, Georgia comes the story of Mauricio Warner. Mr. Warner told individuals that you could receive a “stimulus payment” or “Free Government Money.” Instead, the over 5,000 victims had a tax return filed in their names. The tax returns contained false income amounts and refundable tax credits to generate the erroneous refunds. Of course, the refunds were direct deposited into bank accounts that Mr. Warner controlled.

Mr. Warner was indicted in April, 2013. He was accused of 16 counts of wire fraud, 16 counts of aggravated identity theft, 16 counts of filing false claims, and two counts of money laundering. He was tried earlier this year, and found guilty of all the charges. He was sentenced to 20 years at ClubFed and was ordered to make restitution of $5,041,869. Partial restitution has already occurred; the court ordered forfeiture of seven bank accounts that contained $4,185,455.31. (While there have been abuses of forfeiture, this is a case where it appears to be amply justified.) For the record, Mr. Warner has filed an appeal.

While the IRS continues to spend money on its quixotic goal of regulating all tax professionals, the plague of identity theft continues. Yes, the IRS is making strides and has implemented some ideas that will stop some of this scourge. But priorities at the IRS seem a little off to me: All of the money being directed into the IRS’s Annual Filing Season Program could be redirected into fighting identity theft.

One year I’m hopeful that I’ll write, “I could not find a deserving candidate for the Tax Offender of the Year.” Unfortunately, I suspect that I’ll have plenty to choose from in 2015, too.

That’s a wrap on 2014. I wish everyone a happy, healthy, and safe New Year.

[…] 2014: Mauricio Warner 2013: U.S. Department of Justice 2012: Steven Martinez 2011: United States Congress 2010: Tony and Micaela Dutson 2009: Mark Anderson 2008: Robert Beale 2007: Gene Haas 2005: Sharon Lee Caulder […]

[…] 2014: Mauricio Warner 2013: U.S. Department of Justice 2012: Steven Martinez 2011: United States Congress 2010: Tony and Micaela Dutson 2009: Mark Anderson 2008: Robert Beale 2007: Gene Haas 2005: Sharon Lee Caulder […]