Mr. Murphy says, what can go wrong will go wrong. This was definitely the case for the 2022 Tax Season. In this four-part series, we’re going to cover IRS and government (Congress and the President) failures, our failures, and what we can do to get this right–or at least better–in the future. As for the prognosis, well, it’s not pretty.

For this series:

Part 1 covers IRS and government issues. In Part 2, we’ll look at government solutions and the possibility that any of them will occur. In Part 3, I’ll take a look at taxpayer and tax professional issues this year (including the failures of my company). In Part 4, we’ll look at solutions for taxpayers and tax professionals, and an overall conclusion. So onward into the Tax Season From Hell!

This year began with the promise of a “normal” Tax Season. The pandemic was going to be in the rear-view mirror, we would have the IRS and state tax agencies back to normal, and we could play “Oh What a Beautiful Morning” every day. Let’s see what went wrong with that picture–starting with the failures of the IRS.

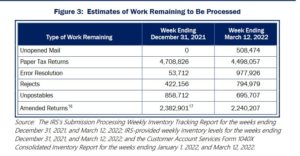

1. The Internal Revenue Service misplaced the word “service.” In actuality, this could be points 1 to 5. The failures of the IRS this year were legion. First, there is some large number of tax returns sitting in bins at IRS Service Centers. As the National Taxpayer Advocate has said, paper is the IRS’s Achilles heal. Well, there are (we think) 20-30 million tax returns and an unknown amount of correspondence that are taking forever (or something akin to that) to be processed. Tax refund processing is 90% of the time excellent. Unfortunately, if you are in the 10% that has to be manually processed it makes the DMV look good. And if you want to make that 10% look good, pity those of you who get an IRS Identity Protection verification notice. It’s close to impossible for you to reach that group. When you make the DMV look good….

2. The IRS issued nonsensical regulations impacting Tax Season, further condensing Tax Season. A perfect example are the new K-2/K-3 regulations. The IRS believed (almost certainly correctly) that they weren’t getting enough information to accurately assess partnerships with foreign operations. So they issued the new Schedule K-2 and K-3 regulations last summer. I looked at them when the rules were issued, but believed (wrongly) that they had little impact on my practice.

Au, contraire! In January (2022), the IRS issued new instructions that (a) causes a circular problem and (b) forced K-2/K-3s onto purely domestic partnerships with no foreign operations and no foreign partners. The instructions state if a partnership has an owner who must file Form 1116 (foreign tax credit), the partnership must issue these Schedules. Assume Acme Manufacturers LLC makes widgets here in Las Vegas. Russ and Scott are the active owners, but there’s a third owner: Martin. Martin is a passive investor, and invests in all sorts of businesses. He and his wife file Form 1116 every year. Thus, under the new instructions Acme must file Schedules K-2 and K-3.

As an experiment, I prepared K-2s and K-3s for my own business. It added about 20 minutes of work, but for a completely domestic entity wasn’t difficult. However, there is no reason that this needs to be done. If Martin is audited, the IRS from the already prepared Schedule K-1 has all the information needed to accurately assess Martin’s liability for his investment in Acme. The IRS doesn’t need the K-2/K-3–it’s useless make-work.

But that’s not all. Let’s assume Martin doesn’t have a Form 1116 filing requirement each year, but occasionally does. What should Debbie, who prepares Acme’s returns do? Include the useless K-2/K-3s which most of the time aren’t needed or wait until September when she might know for certain? Neither answer helps in tax preparation for obvious reasons.

But there are other “make-work” items thrust on tax professionals. We must record IRS Submission ID Numbers (the number assigned by the IRS to each submission of a tax return) on either the signature document or in some other method. It doesn’t take long–but the minute spent on this (and our tax software automatically notes this for posterity) is a waste of time. Consider a tax practice with 500 clients. That’s 500 minutes wasted, or about a day’s worth of work that I must pay someone for. (Yes, that cost is passed on to you, the tax professional’s customer.) There are needless interviews we are required to do with clients regarding various tax credits or I can be fined. And these are just two of many examples.

3. Like all businesses, tax professionals must deal with an array of regulations–many of which are at cross-purposes. And you, the tax professional’s clients, pay for them all. We, like most tax professionals, have an Engagement Letter we require all clients to sign. When I started it was one page. It’s now just over four pages. Why has it grown? Regulations and our litigious society.

The IRS requires I engage in best practices (it’s part of Circular 230, how I’m regulated). I think it’s a good idea to use best practices as much as realistically possible. But we’re not just regulated by the IRS. Other regulatory agencies that have jurisdiction over me include:

- City of Las Vegas Business Licensing

- Clark County (Nevada) Health Department

- State of Nevada Health & Safety

- OSHA

- Federal Trade Commission (FTC)

The above is not an exhaustive list. When I started my office here in Las Vegas the regulatory notices fit on a single poster. They now take two. You, the tax professional’s customer, pay for this. I, the regulated, also pay for this in having to do many things that are not useful but are required by law and regulation.

Please don’t misunderstand me: I do not believe in violating the law. Most regulations and laws are in place for good reasons. However, it’s like mandatory ethics training for two hours every year (and yes, I am required to take that). I listen, and every so often learn something (usually something I must now implement to cover myself, not something that helps taxpayers). I have in the past taught ethics to tax professionals. But consider if I were an unethical tax professional. Couldn’t I just goof off during those two hours since just being in the audience gets me the required continuing education hours? I leave that for you, the reader, to decide.

4. Government regulations cause the tax professional community to shrink. There’s an excellent quote: “Whatever you tax you get less of.” Regulations have the same impact. My professional society, the National Association of Enrolled Agents (NAEA), strongly believes that the IRS should regulate all tax professionals because it would weed out bad preparers. I disagree. If someone wants to be a bad professional, it’s easy and no amount of regulation will stop it. It’s “whack-a-mole.” But regulations also make it harder for me to operate, with costs passed on to you (the taxpayer).

5. Covid regulations. One of my employees got Covid in March. He was ill for one day, and he felt fine and ready to come back to work a couple of days later. Well, one week later he was back in the office. He was out three to five extra days because of regulations. (No one else in our office got Covid, but you will see in Part 3 we weren’t very lucky on the illness side this year.)

For those who think I have just become a killer, well, I disagree. We’ve always had the policy that if you’re ill you go home. That’s common sense. It’s also common sense that (a) Covid is now ubiquitous (if you haven’t had it, unfortunately you will), (b) that anyone who wants to can get vaccinated (now, up to four times), and (c) for almost everyone, Covid today is akin to the flu in the death rate (and the death rate for children without serious pre-existing conditions is 0% per the Wall Street Journal).

Overall, the biggest problems came from the IRS. In Part 2, I look at how we can fix these issues and give you the odds of any of my solutions happening.